Evaluation of DB2 Query Optimizer

and SQL99 Implementation

Pareena Parikh

Independent Study, Summer 2002

New York University, Department of Computer Science

Advisors: Alberto

Lerner, Dennis Shasha

8/9/2002

Abstract

The SQL 99 Standard introduces

much-needed analytical capabilities to relational database querying, resulting

in increased ability to perform dynamic, analytic SQL queries. While the new constructs provide syntax for

more complex calculations, this study focuses on evaluating the ability of the

Relational Database query optimizer to create efficient access plans for

returning results. Particularly, in

this study, we evaluate (i) DB2’s implementation of the SQL 99 Standard in

terms of query readability and development, and (ii) DB2’s query optimizer for

generating access plans – using a test set of irregular and regular time series

financial data, and a benchmark set of analyses. First, our results show that, while the DB2 implementation

provides sufficient syntax for most queries considered, it does leaves some

room for improvement from a query readability and development standpoint. While we are able to find “work-arounds” to

achieve complex calculations, some examples of deficiencies we noted include

the lack of FIRST/LAST aggregate functions and lack of PRODUCT aggregate

function. Second, we find that, for the

cases considered, the DB2 Optimizer performs well in terms of optimizing

aggregations that use the OVER clause, and performs average in terms of general

SORT Order Management. Some examples of

deficiencies noted are extraneous sorts or sorts that occur later in the access

plan than necessary. Some examples of

efficiencies noted are consolidation of SORTS so that they handle multiple aggregations

on the same OVER partition, propagation of SORT results from one partition to a

superset partition (i.e., for example, the sort on week(tradedate) to

month(tradedate) to year(tradedate) – each result is propagated to the next

instead of performing each one independently).

Table of Contents

1.

Introduction

2.

Objective

3.

Background

3.1.

SQL99

4.

Query Optimization

4.1.

Cost Based Optimization

4.2. Logical

Plan Optimization

4.3.

Physical Plan Optimization

5.

Experimental Design

5.1.

Tick Database

5.1.1.

Data Model

5.2.

Markets Database

5.2.1.

Data Model

6.

Experimental Setup

7.

Test Results Detail

7.1.

Ticks

7.1.1.

Query Spec

7.1.2.

Syntax and Access Plans

7.1.3.

Detailed Analysis

7.2.

Markets

7.2.1.

Query Spec

7.2.2.

Syntax and Access Plans

7.2.3.

Detailed Analysis

8.

Test Results Summary

8.1.

Query Readability

8.2.

Query Optimization

9.

Analysis and Conclusions

9.1.

Query Readability

9.2.

Plan Optimization

References

Introduction

Relational databases form the foundation of many systems,

both in industry and in academics, ranging in application from ERP systems to

data warehouses to e-commerce platforms.

The power of databases comes from a body of knowledge and technology

that has developed over several decades.

Some types of databases are: hierarchical, network, inverted list, and

relational. Most applications rely on

relational databases, which are commonly available in the form of Relational

Database Management Systems (RDBMS).

Among other features, an RDBMS provides users with

persistent storage, a programming interface, and transaction management [1]

. RDBMS’ generally have many different

components – including a transaction manager, query compiler, execution engine,

logging and recovery modules, concurrency control modules, and storage managers

[2]. For the purposes of this study, we

will focus on the query compiler, which is the one component that affects data

retrieval performance most. The query

compiler contains 3 parts:

1)

query parser

2)

query preprocessor

3)

query optimizer

We will measure the performance of the query optimizer,

which transforms the initial query plan – generated by the query preprocessor –

into the best available sequence of operations on the actual data, in this

study.

IBM initially introduced DB2 version 1.0 as its RDBMS in

1984. Since then, it has seen many

versions and has gained credibility as one of the major RDBMS products in

industry.

Objective

The purpose of this study is to evaluate DB2’s capability to

optimize SQL statements, with a particular emphasis on the SQL 99 standard OLAP

functions. This qualitative analysis

will rate DB2 in the areas of access plan generation and query readability, and

provide a foundation for detailed performance benchmarks.

In the next two sections we are going to introduce the OLAP

extensions of SQL:1999 and give an overview of the internal workings of an

optimizer that compiles such queries The reader familiar with these topics

could skip to section 5, Experimental Design.

Background

SQL 99 Standard for Analytics

With the advent of SQL 99, the SQL language has advanced

data partitioning and ordering capabilities, which lends well to analysis. Particularly, the OLAP Functions provide

aggregation and windowing constructs.

Database vendors implement and, in some cases, extend the standard in

slightly different ways. As we are

evaluating DB2, we will review its implementation here. DB2 provides the following OLAP

specification [3]:

OLAP-function |--+-| ranking-function |-----+---------------------------------| +-| numbering-function |---+ '-| aggregation-function |-' ranking-function |---+-RANK ()-------+--OVER-------------------------------------> '-DENSE_RANK ()-' >----(--+------------------------------+------------------------> '-| window-partition-clause |--' >----| window-order-clause |--)---------------------------------| numbering-function |---ROW_NUMBER ()--OVER---(--+------------------------------+---> '-| window-partition-clause |--' >----+--------------------------+---)---------------------------| '-| window-order-clause |--' aggregation-function|---column-function--OVER---(--+------------------------------+-> '-| window-partition-clause |--' >----+--------------------------+-------------------------------> '-| window-order-clause |--' .-RANGE BETWEEN UNBOUNDED PRECEDING AND UNBOUNDED FOLLOWING--.>----+------------------------------------------------------------+---)-> '-| window-aggregation-group-clause |------------------------' >---------------------------------------------------------------| window-partition-clause .-,--------------------------. V ||---PARTITION BY-----partitioning-expression---+----------------| window-order-clause .-,-------------------------------. V .-ASC--. ||---ORDER BY-----sort-key-expression--+------+--+---------------| '-DESC-' window-aggregation-group-clause|---+-ROWS--+---+-| group-start |---+---------------------------| '-RANGE-' '-| group-between |-' group-start|---+-UNBOUNDED PRECEDING-----------+---------------------------|+-unsigned-constant--PRECEDING--+ '-CURRENT ROW-------------------' group-between|---BETWEEN--| group-bound1 |--AND--| group-bound2 |------------| group-bound1|---+-UNBOUNDED PRECEDING-----------+---------------------------|+-unsigned-constant--PRECEDING--+ +-unsigned-constant--FOLLOWING--+ '-CURRENT ROW-------------------' group-bound2|---+-UNBOUNDED FOLLOWING-----------+---------------------------|+-unsigned-constant--PRECEDING--+ +-unsigned-constant--FOLLOWING--+ '-CURRENT ROW-------------------'

On-Line Analytical Processing (OLAP) functions

provide the ability to return ranking, row numbering and existing column

function information as a scalar value in a query result. An OLAP function

can be included in expressions in a select-list or the ORDER BY clause of a

select-statement (SQLSTATE 42903). An OLAP function cannot be used as an

argument of a column function (SQLSTATE 42607). The query result to which the

OLAP function is applied is the result table of the innermost subselect that

includes the OLAP function. When specifying an OLAP function, a window is

specified that defines the rows over which the function is applied, and in

what order. When used with a column function, the applicable rows can be

further refined, relative to the current row, as either a range or a number

of rows preceding and following the current row. For example, within a

partition by month, an average can be calculated over the previous three

month period. The ranking functions, RANK and DENSE_RANK, compute

the ordinal rank of a row within the window. Rows that are not distinct with

respect to the ordering within their window are assigned the same rank. The

results of ranking may be defined with or without gaps in the numbers

resulting from duplicate values. The ROW_NUMBER 37

function computes the sequential row number of the row within the window

defined by the ordering, starting with 1 for the first row. If the ORDER BY

clause is not specified in the window, the row numbers are assigned to the

rows in arbitrary order as returned by the subselect (not according to any

ORDER BY clause in the select-statement). |

In addition, SQL 99 introduces the WITH clause for use with

the SELECT statement, allowing for more flexible sub-querying and a more

intuitive syntactic representation of subqueries as “local” views. One of the main benefits of this DB2

provides the following WITH clause implementation [4]:

|

SELECT STATEMENT >>-+-----------------------------------+--fullselect------------> | .-,-----------------------. | | V | | '-WITH----common-table-expression-+-' >--+-----------------+--+--------------------+------------------> '-order-by-clause-' '-fetch-first-clause-' .----------------------. V | (1) (2)>----+------------------+-+------------------------------------>< +-update-clause----+ +-read-only-clause-+ +-optimize-clause--+ '-isolation-clause-'

Notes: 1.

The

update-clause and read-only-clause cannot both be specified in the 2.

Each

clause may be specified only once. The select-statement is the form of a query

that can be directly specified in a DECLARE CURSOR statement, or prepared and

then referenced in a DECLARE CURSOR statement. It can also be issued

interactively, using the interactive facility (STRSQL command), causing a

result table to be displayed at your work station. In either case, the table

specified by a select-statement is the result of the fullselect. COMMON TABLE EXPRESSION >>-table-name--+-----------------------+--AS--(--subselect--)-->< | .-,-----------. | | V | |

'-(----column-name-+--)-' A common-table-expression permits

defining a result table with a table-name that can be specified as

a table name in any FROM clause of the fullselect that follows. The table-name

must be unqualified. Multiple common table expressions can be specified

following the single WITH keyword. Each common table expression specified can

also be referenced by name in the FROM clause of subsequent common table

expressions. If a list of columns is specified, it must consist

of as many names as there are columns in the result table of the subselect.

Each column-name must be unique and unqualified. If these column

names are not specified, the names are derived from the select list of the

subselect used to define the common table expression. The table-name of a common table

expression must be different from any other common table expression

table-name in the same statement. A common table expression table-name

can be specified as a table name in any FROM clause throughout the

fullselect. A table-name of a common table expression overrides

any existing table, view, or alias (in the catalog) with the same qualified

name. If more than one common table expression is

defined in the same statement, cyclic references between the common table

expressions are not permitted. A cyclic reference occurs when two

common table expressions dt1 and dt2 are created such

that dt1 refers to dt2 and dt2 refers to dt1.

A common-table-expression is also

optional prior to the subselect in the CREATE VIEW and INSERT statements. A common-table-expression can be used: ·

In place of a view to avoid creating the view (when

general use of the view is not required and positioned updates or deletes are

not used ·

When the desired result table is based on host variables ·

When the same result table needs to be shared in a fullselect

If a subselect of a common table

expression contains a reference to itself in a FROM clause, the common table

expression is a recursive table expression. |

Query Optimizer

The Query Optimizer of a relational database consists of two

parts: (i) the logical plan

generation, during which the query parse tree is converted into an initial

query plan, which is then transformed into an equivalent logical plan that is

expected to require less time to execute, and (ii) physical plan generation,

where the abstract query plan is turned into a physical query plan by selecting

algorithms to implement each operator in the logical query plan, and an order

of execution for these operators [5].

Cost Based Optimization

We assume that cost of evaluating an expression is approximated by the number of disk I/Os performed. The number of disk I/Os is influenced by [7]:

· The

particular logical operators chosen to implement the query.

· The size of

intermediate relations.

· The

physical operators used to implement the logical operators.

·

The ordering of similar operations.

· The method

of passing arguments from one physical operator to the next.

Logical Plan Optimization

Pushing Down

Selections

Selections are crucial operations because they reduce the

size of relations significantly. One of

the most important rules of efficient query processing is to move selections

down the tree as far as they will go without changing what the expression does

[6]. If a selection condition is the

AND of several conditions, then we can split the condition and push each piece

down the tree separately.

Choosing Join Order

Selecting the join order for the join of three or more

relations is a critical problem in query optimization. The one-pass join reads one relation

(preferably the smaller) into main memory, creating a hash table to facilitate

matching of tuples from the other relation.

It then reads the other relation, one block at a time, to join its

tuples with the tuples stored in memory.

In this case, the left argument of the join is the smaller relation that

is to be stored in main memory while the right argument of a join is read a

block at a time and matched to the stored relation. Other join algorithms include:

nested loop joins, and index joins [10].

Heuristics for Reducing the Cost of the Logical Query Plan

There are many heuristics for reducing the cost of the logical

query plan. By estimating the cost both

before and after a transformation, the optimizer decides to keep the

transformation where it appears to reduce cost, and avoid the transformation

otherwise [9].

Physical Plan Optimization

Choosing Selection Method

In the physical plan optimization step, the optimizer must

estimate the lowest cost selection operation.

An outline of how costs are estimated is as follows [11]:

1)

The cost of Table Scan coupled with Filter, a) if relation

is clustered, or b) if relation is not clustered.

2)

The cost of an algorithm that picks an equality term such as

a=10 for which an index on attribute a exists uses Index Scan to find

the matching tuples, and then filters the retrieved tuples to see if they match

the full condition, a) if the index is clustering, b) if the index is

non-clustering

3)

The cost of an algorithm that picks an inequality term such

as b<20 for which an index on attribute b exists uses Index Scan to

find the matching tuples, and then filters the retrieved tuples to see if they

match the full condition, a) if the index is clustering, b) if the index is

non-clustering.

Choosing Join Method

Several options exist when choosing the join method. Some approaches are [12]:

1) One pass

join – this approach assumes that the buffer manager can devote enough buffers

to the join, or that the buffer manager can come close so that thrashing is not

a major problem. An alternative is

the Nested Loop join.

2)

Sort Join

3)

Index Join

4)

Multipass Join using hashing

Materialization versus Pipelining

The approach where each intermediate relation in a query

plan is stored on disk for the next operation in sequence to access is termed

“materialization”. A more subtle and

generally more efficient way to execute a query plan is to have several operations

running at once. The tuples produced

by one operation are passed directly to the operation that uses it, without

ever storing the intermediate tuples on disk.

This approach is called “pipelining”.

Experimental Design

The test database, including data model and generated data,

was based on the FinTime Specification, a financial time series benchmark,

authored by Dennis Shasha and available at www.cs.nyu.edu/cs/faculty/shasha/fintime.d/bench.html. The specification consists of two

databases: Ticks and Markets.

Tick Database

Ticks are price quotations of trade prices and associated

attributes for individual securities that occur either on the floor of a stock

exchange or in an electronic trading system.

Ticks include two basic types of data:

1) trades that are transactions between buyers and sellers at a fixed

price and quantity, and 2) Quotes that are the price quotations offered by

buyers and sellers.

Data Model

The data model is as follows, with

TICK_BASE having a 1:Many relation with TICK_PRICE2 on ID:

Markets Database

Market information is provided as a set of files by a market

data vendor, available at the end of each trading day. Thus, the market data contains an entry for

each security for each trading day, a regular time series. Along with this data, we have dividends

and splits, each of which are irregular time series, representing events that

affect the price and volume of particular securities.

Data Model

The data model is as follows, with HIST_BASE having a 1:Many

relation with HIST_PRICE2, HIST_SPLIT2, and HIST_DIVIDEND2:

Experimental Setup

Data for all tables except

Splits and Dividends was generated into comma delimited flat files using a C++

program designed for the FinTime benchmark.

Splits and Dividend data was

generated manually (by running an insert statement for each row). For the Ticks Database, we generated ticks

for 5 securities with ~5500 ticks per day for 10 days, resulting in 284000 rows

in the TICK_PRICE2 table. For the

Markets Database, we generated data for 500 securities for 30 days (and by

definition, there is one record per day),

resulting in 15000 rows in the HIST_PRICE2 table. For Splits, we generated splits for 10

securities, some of which had multiple splits.

For Dividends, we generated 3 dividends for 5 securities, resulting in

15 rows in the HIST_DIVIDEND2 table.

Schema Generation and Data

Loading for most tables were done via the DB2 Control Center. Splits and Dividends were loaded using

Insert statements.

Test Results Detail

The testing was done incrementally for

each query. By adding database

optimizations or rearranging clauses/syntax in each phase, we attempt to show

how the optimizer performs under different circumstances. In this section, we show the details of

each query that was executed, and its access plans. The following section evaluates the DB2 optimizer and readability

with respect to each query.

Ticks Database

Query 1

Specification:

|

1 |

Get all ticks for

a specified set of 100 securities for a specified three hour time period on a

specified trade date. |

Syntax and Access Plans:

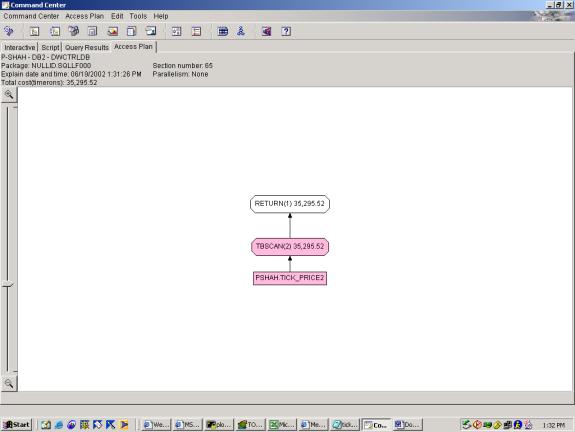

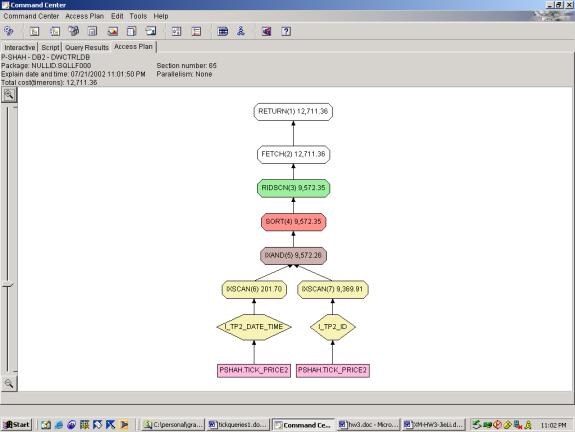

Two attempts were made at this simple query. The syntax is the same in each attempt, but in the first case, we have no indexes, and in the second case, we have an index on ID and an index on TRADEDATE, TIMESTAMP.

--Q1.1 SELECT TICKS (NO INDEXES)

SELECT *

FROM tick_price2

WHERE tradedate = '06/13/2002'

AND timestamp BETWEEN '09:00:00' AND '12:00:00'

AND id LIKE 'id_5%'

--Q1.2 SELECT TICKS (WITH INDEXES)

SELECT *

FROM tick_price2

WHERE tradedate = '06/13/2002'

AND timestamp BETWEEN '09:00:00' AND '12:00:00'

AND id LIKE 'id_5%'

Detailed Analysis: This query was a simple selection with 3 predicates. The criteria were changed slightly to accommodate the generated data, but shouldn’t affect the overall plan. The first query attempt shows a basic access plan. The second query attempt shows use of both indexes, with an INDEX AND to merge the results, and interestingly, the optimizer chooses to SORT the result of the INDEX AND on ROWID prior to looking up rows. This is very smart because it saves multiple lookups to the same page (which would be the case if it was not sorted on ROWID).

Query 2

Specification:

|

2. |

Determine the

volume weighted price of a security considering only the ticks in a specified

three hour interval |

Syntax and Access Plans:

Two attempts were made at this query. The syntax is the same in each attempt, but in the first case, we have no indexes, and in the second case, we have an index on ID and an index on TRADEDATE, TIMESTAMP.

--Q2.1 VOLUME WEIGHTED PRICE (NO INDEXES)

SELECT id,

sum(tradesize*tradeprice)/sum(tradesize)

FROM tick_price2

WHERE tradedate = '06/13/2002'

AND timestamp BETWEEN '09:00:00' AND '12:00:00'

AND id LIKE 'Security%'

GROUP BY id

--Q2.2 VOLUME WEIGHTED PRICE ( INDEXES )

SELECT id,

sum(tradesize*tradeprice)/sum(tradesize)

FROM tick_price2

WHERE tradedate = '06/13/2002'

AND timestamp BETWEEN '09:00:00' AND '12:00:00'

AND id LIKE 'Security%'

GROUP BY id

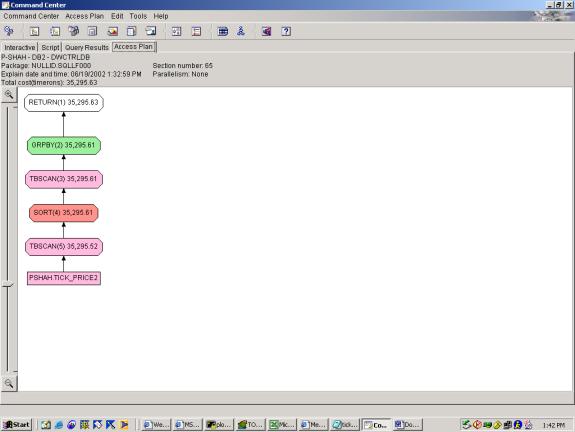

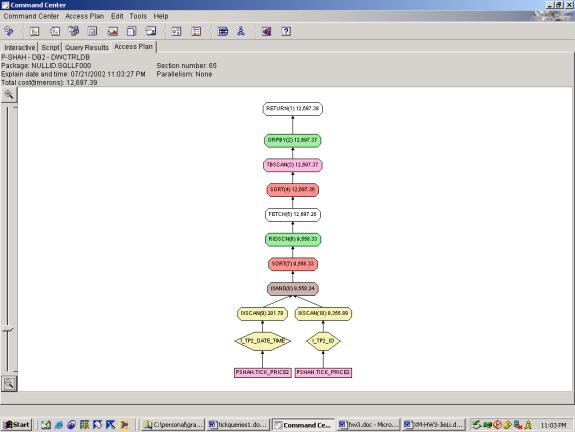

Detailed Analysis:

This query was a selection with 3 predicates and 1 aggregation. The criteria were changed slightly to

accommodate the generated data, but shouldn’t affect the overall plan. The first query attempt shows a basic access

plan with the <SORT, TABLESCAN, GROUPBY> pattern to accomplish the

aggregation. The TABLESCAN in this pattern is a low-cost scan

of the temporary table that the SORT result was stored into (this is done

presumably to provide for the case where the SORT result is too large to fit in

memory). The second query attempt shows

the same, however it uses both indexes, with an INDEX AND to merge the results,

and interestingly, the optimizer chooses to SORT the result of the INDEX AND on

ROWID prior to looking up rows. This is

very smart because it saves multiple lookups to the same page (which would be

the case if it was not sorted on ROWID).

Query 3

Specification:

|

3. |

Determine the top

10 percentage losers for the specified date on the specified exchanges sorted

by percentage loss. The loss is calculated as a percentage of the last trade

price of the previous day. |

Syntax and Access Plans:

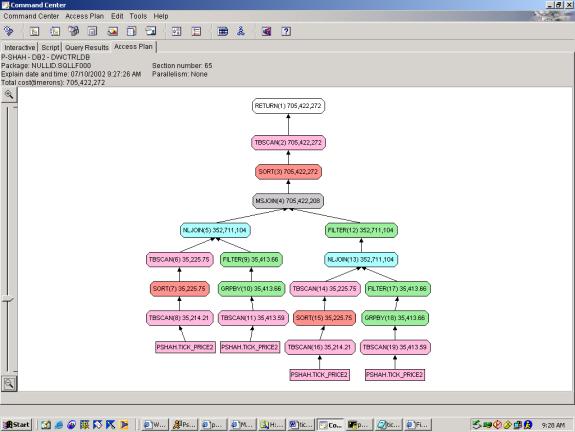

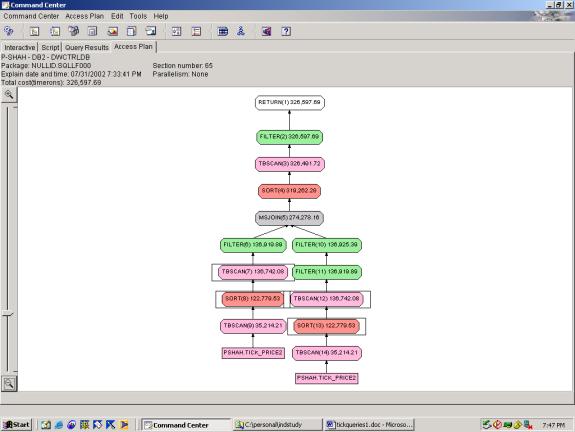

Nine attempts were made on this query. Q3.9 shows the worst case scenario, where

we have 2 subqueries, with 1 subquery each, that each require a full table scan

on the original table, TICK_PRICE2.

The structure is as follows:

The results of the each pair – the subquery and

sub-sub-query -- are joined using a very costly nested loop join, and then the

results of the 2 nested loop joins are joined in a merge join. Q3.8 shows the same query syntax, but

improves the situation (reducing cost to 1/5 of Q3.9) by adding two indexes,

one on ID and the other on TRADEDATE, TIMESTAMP. The plan is very similar in the sequence of operations, except

that it uses index scans instead of full tablescans. Q3.7 is a query rewrite that changes the nesting so that there

are essentially 4 subqueries and 0 sub-sub-queries. Thus, the 2 costly nested loop joins are removed and instead we

merge join 2 subqueries, the results of which are then joined in a nested loop

join:

![]()

This restructuring of the query, and reversal of the join

types in the access plan significantly improves performance (by 30%). Q3.6 query rewrite further improves the

situation by reducing from 4 to 3 subqueries (and more importantly from 4 to 3

full tablescans on TICK_PRICE2).

Realizing that we can get yesterday’s and today’s max timestamp for each

id in one query, we are able to reduce the cost. Interestingly, we access the twodays subquery twice in the main

SELECT clause, but it doesn’t add much to the cost since the twodays table is

so small (in comparison to TICK_PRICE2).

Q3.5 query rewrite cuts cost nearly in half by adding an OVER clause in

order to obtain max timestamp in the same query as the rest of the information,

bumping down from 3 to 2 full tablescans.

The results of the 2 subqueries are then joined in a merge join. Q3.4 adds the extra top ten filter (which

up until now was assumed to be done at the client), with little extra

cost. The plan is exactly the same as

Q3.5 with the exception of the aggregation at the end. This <sort, aggregation and filter> is

low cost presumably since the data set is so small at this point. Q3.3 shows yet another milestone, reducing

down from 2 full tablescans to 1 full tablescan by adding a tricky OVER clause

to get previous day price and current day price in the same row. In this

case, the WITH clause was key because it allows us to build one query off of

another query without rewriting it as a subquery. We reduce cost by another 25% in this pass. With one tablescan on the original table,

there is essentially no join operation (the nested loop join that appears is

very low cost because it joins a single row with the result of the single

tablescan) and the single sort takes care of both the sort on the original

table and the sort which gets us the previous price. Q3.2 tests how well the optimizer performs in pushing down

filters. It is similar to Q3.3, however

it moves the filters into the main SELECT clause instead of in the 2

subqueries. The results show that the

optimizer does not push down the filters, thus the sort is much more costly

(due to a larger data set), and the cost shoots up to 3 times that in Q3.3).

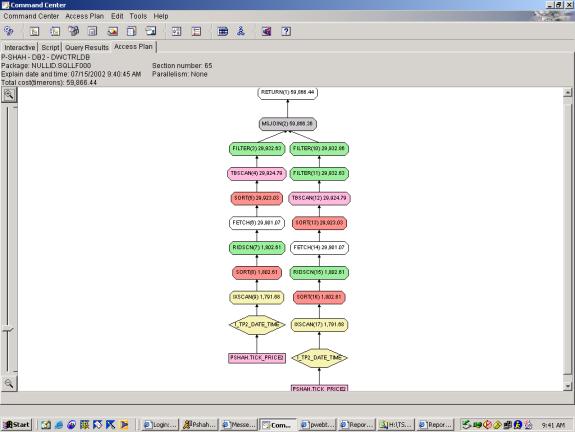

The final pass, Q3.1, is the most efficient plan and retrieves results that are closest

to the specification. It is essentially

a rewrite of Q3.3 with the only difference being that it performs the top ten

filter. Interestingly, the cost is only

slightly larger than without the top ten filter. This may be due to the fact that the data set is so small by the

time it gets to the ranking, and thus the sort on rank is low-cost.

--Q3.1 TOP 10 PERCENTAGE LOSERS (1 TABLE SCAN ON TICK_PRICE2, USES OVER, TOP TEN FILTER INCLUDED)

Adding top ten:

WITH

LAStTs (id, tradedate, tradeprice,

lASttime) AS

(SELECT id,

tradedate,

tradeprice,

ROW_NUMBER() OVER (PARTITION

BY id, tradedate ORDER BY timestamp

DESC) AS rown

FROM Tick_price2

WHERE tradedate='6/21/2002' or

tradedate='6/20/2002'),

CurrTs (id, tradedate, tradeprice,

prevprice) AS

(SELECT id,

tradedate,

tradeprice,

avg(tradeprice) OVER (PARTITION

BY id ORDER BY tradedate ASc ROWS

BETWEEN 2 preceding AND 1 preceding)

FROM LAStTs

WHERE lASttime=1),

result (id, percLoss,percLossRank)

AS

(SELECT id,

(prevprice-tradeprice)*100/prevprice

perc_loss, rank() OVER (ORDER BY (prevprice-tradeprice)*100/prevprice)

FROM CurrTs

WHERE tradedate='6/21/2002')

SELECT *

FROM result

WHERE percLossRank<4

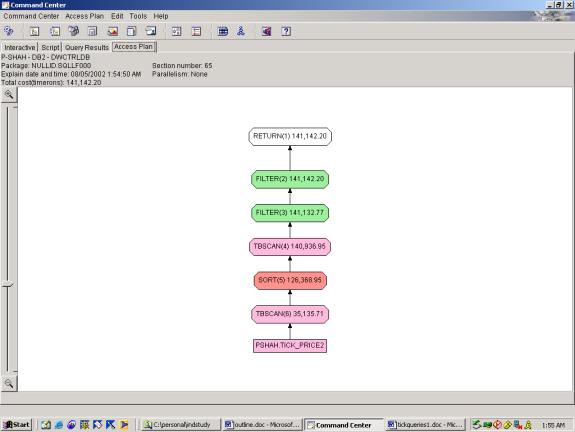

--Q3.2 TOP 10 PERCENTAGE LOSERS (1 TABLE SCAN ON

TICK_PRICE2, USES OVER, CLIENT SIDE TOP TEN FILTER & SORT, ATTEMPT TO MAKE

OPTIMIZER PUSH DOWN FILTERS)

WITH

LAStTs (id, tradedate, tradeprice,

lASttime) AS

(SELECT id,

tradedate,

tradeprice,

ROW_NUMBER() OVER (PARTITION

BY id, tradedate ORDER BY timestamp

DESC) AS rown

FROM Tick_price2),

CurrTs (id, tradedate, tradeprice,

prevprice) AS

(SELECT id,

tradedate,

tradeprice,

avg(tradeprice) OVER (PARTITION

BY id ORDER BY tradedate ASc ROWS

BETWEEN 2 preceding AND 1 preceding)

FROM LAStTs

WHERE lASttime=1)

SELECT id,

tradedate,

tradeprice,

prevprice,

(prevprice-tradeprice)*100/prevprice

perc_loss

FROM

CurrTs

WHERE tradedate='6/20/2002' or tradedate='6/19/2002'

Total cost=141142.20

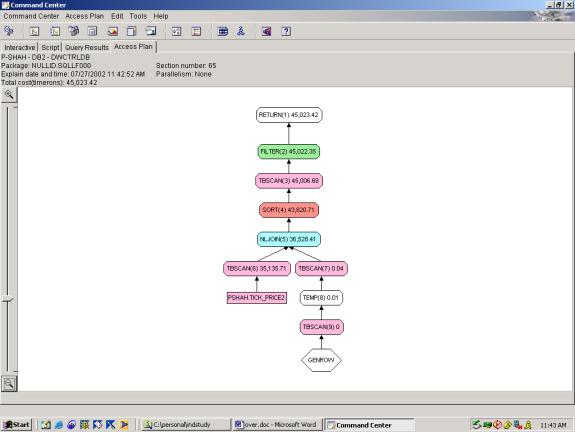

--Q3.3 TOP 10 PERCENTAGE LOSERS (1 TABLE SCAN ON TICK_PRICE2, USES OVER,

CLIENT SIDE TOP TEN FILTER & SORT)

WITH

LAStTs (id, tradedate, tradeprice,

lASttime) AS

(SELECT id,

tradedate,

tradeprice,

ROW_NUMBER() OVER (PARTITION

BY id, tradedate ORDER BY timestamp

DESC) AS rown

FROM Tick_price2

WHERE tradedate='6/20/2002' or

tradedate='6/19/2002'),

CurrTs (id, tradedate, tradeprice,

prevprice) AS

(SELECT id,

tradedate,

tradeprice,

avg(tradeprice) OVER (PARTITION

BY id ORDER BY tradedate ASc ROWS

BETWEEN 2 preceding AND 1 preceding)

FROM LAStTs

WHERE lASttime=1)

SELECT id,

tradedate,

tradeprice,

prevprice,

(prevprice-tradeprice)*100/prevprice

perc_loss

FROM

CurrTs

Total cost=45023.42

--Q3.4 TOP 10 PERCENTAGE LOSERS (2 TABLE SCANS ON

TICK_PRICE2, USES OVER, TOP TEN FILTER INCLUDED)

WITH

LAStTs (id, tradedate, tradeprice,

lASttime) AS

(SELECT id,

tradedate,

tradeprice,

ROW_NUMBER() OVER (PARTITION

BY id, tradedate ORDER BY timestamp DESC) AS rown

FROM Tick_price2

WHERE tradedate='6/12/2002'),

CurrTs (id, tradedate, tradeprice,

lASttime) AS

(SELECT id,

tradedate,

tradeprice,

ROW_NUMBER() OVER (PARTITION

BY id, tradedate ORDER BY timestamp

DESC) rown

FROM Tick_price2

WHERE tradedate='6/13/2002'),

allids (id, rank) AS

(SELECT a.id,

rank() OVER

(ORDER BY a.tradeprice*100/b.tradeprice DESC)

FROM

LAStTs a, CurrTs b

WHERE

a.id=b.id

AND a.lASttime=1

AND b.lASttime=1)

SELECT id

FROM allids

WHERE rank<11

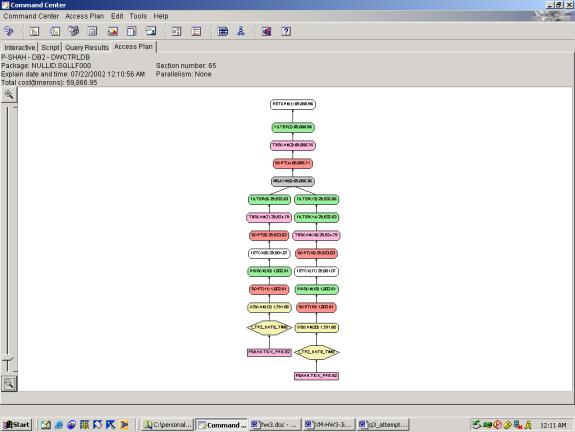

--Q3.5 TOP 10 PERCENTAGE LOSERS (2 TABLE SCAN ON

TICK_PRICE2, USES OVER, CLIENT SIDE TOP TEN FILTER AND SORT)

WITH

LAStTs (id, tradedate, tradeprice,

lASttime) AS

(SELECT id,

tradedate,

tradeprice,

ROW_NUMBER() OVER (PARTITION

BY id, tradedate ORDER BY timestamp

DESC) AS rown

FROM Tick_price2

WHERE tradedate='6/12/2002'),

CurrTs (id, tradedate, tradeprice,

lASttime) AS

(SELECT id,

tradedate,

tradeprice,

ROW_NUMBER() OVER (PARTITION

BY id, tradedate ORDER BY timestamp

DESC) rown

FROM Tick_price2

WHERE tradedate='6/13/2002')

SELECT a.id,

a.tradeprice*100/b.tradeprice

FROM LAStTs a, CurrTs b

WHERE a.id=b.id

AND a.lASttime=1

AND b.lASttime=1

total cost= 59M

--Q3.6 TOP 10 PERCENTAGE LOSERS (3 TABLE SCANS ON TICK_PRICE2,

CLIENT SIDE TOP TEN FILTER AND SORT)

WITH

twodays

(id,tradedate,timestamp) AS

(SELECT id, tradedate,max(timestamp)

FROM tick_price2

WHERE tradedate='6/12/2002' or

tradedate='6/13/2002'

GROUP BY id, tradedate )

SELECT b.tradeprice*100/a.tradeprice,

b.id

FROM

tick_price2 a,

tick_price2 b,

twodays c,

twodays d

WHERE a.timestamp=c.timestamp

AND a.id=c.id

AND a.tradedate='6/12/2002'

AND c.tradedate='6/12/2002'

AND b.timestamp=d.timestamp

AND b.id=d.id

AND b.tradedate='6/13/2002'

AND d.tradedate='6/13/2002'

--Q3.7 TOP 10 PERCENTAGE LOSERS (3 JOIN, CLIENT SIDE TOP TEN

FILTER AND SORT)

WITH

yesterday

(id,timestamp) AS (SELECT id,

max(timestamp) FROM tick_price2 WHERE tradedate='6/12/2002' GROUP BY id),

today (id, timestamp) AS (SELECT

id, max(timestamp) FROM tick_price2 WHERE tradedate='6/13/2002' GROUP BY id)

SELECT b.tradeprice*100/a.tradeprice,

b.id

FROM

tick_price2 a,

tick_price2 b,

today,

yesterday

WHERE a.timestamp=yesterday.timestamp

AND a.id=yesterday.id

AND a.tradedate='6/12/2002'

AND b.timestamp=today.timestamp

AND b.id=today.id

AND b.tradedate='6/13/2002'

--Q3.8 TOP 10 PERCENTAGE LOSERS (3 JOIN, CLIENT SIDE TOP TEN

FILTER)

SELECT (z.tradeprice*100)/y.tradeprice, z.id

FROM

(SELECT tradeprice,id

FROM tick_price2 x

WHERE timestamp=(SELECT

max(timestamp) FROM tick_price2 WHERE id=x.id AND tradedate='06/12/2002')

AND tradedate='06/12/2002') y,

(SELECT tradeprice,id

FROM tick_price2 w

WHERE timestamp=(SELECT

max(timestamp) FROM tick_price2 WHERE id=w.id AND tradedate='06/13/2002')

AND tradedate='06/13/2002') z

WHERE y.id=z.id

ORDER BY (z.tradeprice*100)/y.tradeprice DESC

--Q3.9 TOP 10 PERCENTAGE LOSERS (3 JOIN, CLIENT SIDE TOP TEN

FILTER)

SELECT (z.tradeprice*100)/y.tradeprice, z.id

FROM

(SELECT tradeprice,id

FROM tick_price2 x

WHERE timestamp=(SELECT

max(timestamp) FROM tick_price2 WHERE id=x.id AND tradedate='06/12/2002')

AND tradedate='06/12/2002') y,

(SELECT tradeprice,id

FROM tick_price2 w

WHERE timestamp=(SELECT

max(timestamp) FROM tick_price2 WHERE id=w.id AND tradedate='06/13/2002')

AND tradedate='06/13/2002') z

WHERE y.id=z.id

ORDER BY (z.tradeprice*100)/y.tradeprice DESC

Detailed Analysis:

The progression of Query 3 shows many different aspects of the DB2

optimizer. First, the optimizer did not

push down filters very well in this case as shown by Q3.2 and Q3.3. Second, the WITH clause enables more

efficient access plans, because it allows one subquery to refer to another

without rewriting/re-executing as shown in Q3.3. Third, the ranking function, particularly when used as a top ten

filter on a set of results doesn’t add much cost to the plan – that is, the

optimizer realizes that the data set is so small at this point. Fourth, the optimizer fails to use the INDEX

on ID or on TRADEDATE in attempts 3.1 to 3.4 – possibly due to complexity of

the query. Fifth, with clever thinking

and use of the OVER clause with different partitions, a query can be rewritten

such that it goes from 4 full table scans to 1 full table scans. In this case, as well as others, the extra

time taken to write the query results in enormous cost savings.

Query 4

Specification:

|

4. |

Determine the top

10 most active stocks for a specified date sorted by cumulative trade volume

by considering all trades |

Syntax and Access Plans:

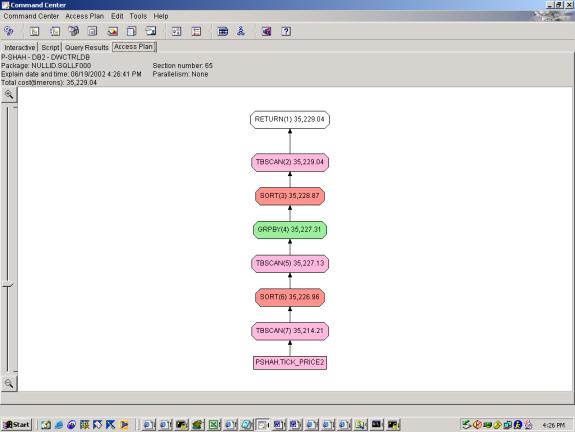

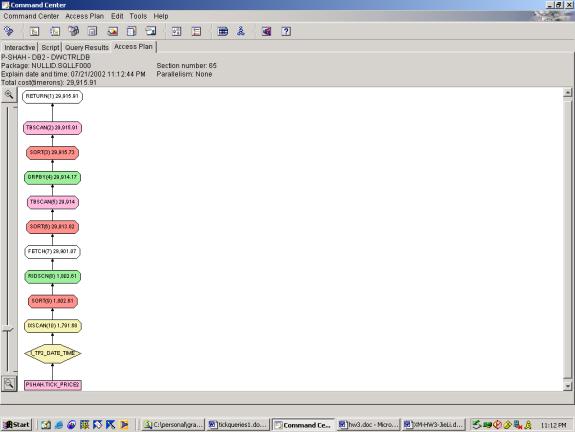

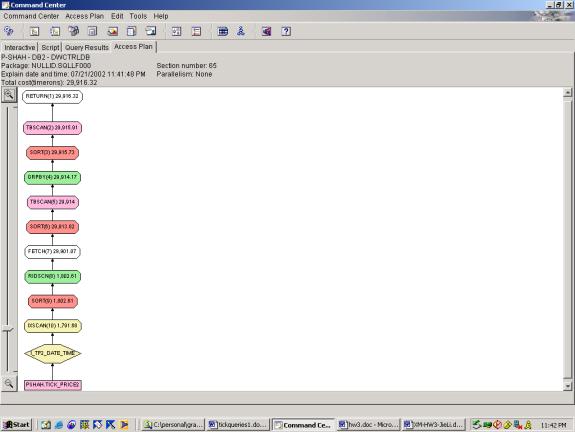

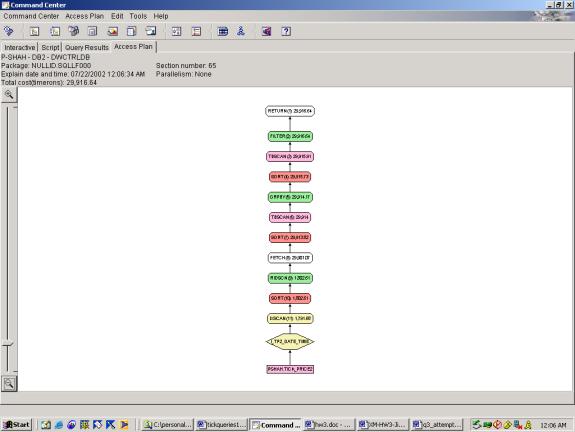

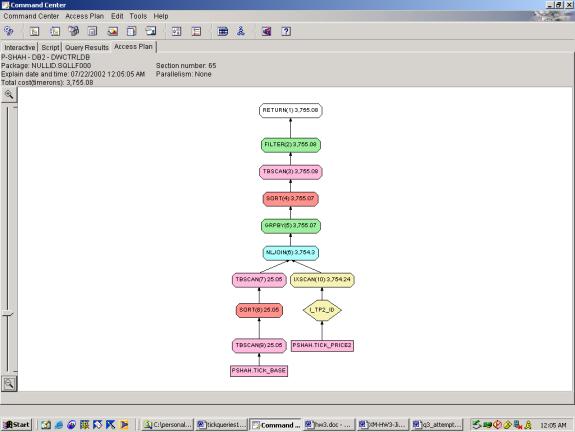

4 attempts were made at this simple query, which involves 1 aggregation,

1 predicate and a top ten filter. The

first, Q4.1, shows the most basic access plan with a full table scan on the

table, followed by the <sort, tablescan, group by> pattern to achieve the

aggregation, and a final sort on the aggregated result. The plan is adequate, and under the

circumstances, we cannot suggest a better one.

Q4.2 improves on this due to the addition of an index on TRADEDATE,

TIMESTAMP. The plan substitutes an

INDEX SCAN + ROWiD LOOKUPS for the TABLE SCAN, and achieves 18% savings. Q4.3 adds a numerical rank to the query, but

doesn’t change the access plan or cost estimate. Q4.4 adds a filter on the top ten ranks, causing the addition of

a FILTER to the access plan – as expected.

--Q4.1 TOP TEN ACTIVE STOCKS (NO INDEXES, CLIENT SIDE TOP

TEN FILTER)

SELECT sum(tradesize), id

FROM tick_price2

WHERE tradedate='06/13/2002'

GROUP BY id

ORDER BY sum(tradesize) DESC

--Q4.2 TOP TEN ACTIVE STOCKS (INDEXES, CLIENT SIDE TOP TEN

FILTER)

SELECT sum(tradesize), id

FROM tick_price2

WHERE tradedate='06/13/2002'

GROUP BY id

ORDER BY sum(tradesize) DESC

--Q4.3 TOP TEN ACTIVE STOCKS (INDEXES, CLIENT SIDE TOP TEN

FILTER, USES OVER)

SELECT id, rank() OVER (ORDER BY sum(tradesize))

FROM tick_price2

WHERE tradedate='06/13/2002'

GROUP BY id

--Q4.4 TOP TEN ACTIVE STOCKS (INDEXES, TOP TEN FILTER

INCLUDED, USES OVER)

WITH

allids (id, rank) AS

(SELECT id, rank() OVER (ORDER BY

sum(tradesize))

FROM tick_price2

WHERE tradedate='06/13/2002'

GROUP BY id)

SELECT id

FROM allids

WHERE rank<11

Detailed Analysis:

This query doesn’t reveal much new information about the optimizer’s

abilities. Similar to Query 3, the

top ten filter and ranking function adds very little cost to the overall

plan. Also, the sequence of operations

is as expected – there is no other way to generate the rank then to do it after

the aggregation step since it depends on the results of the aggregation.

Query 5

Specification:

|

5. |

Find the most

active stocks in the "COMPUTER" industry (use SIC code) |

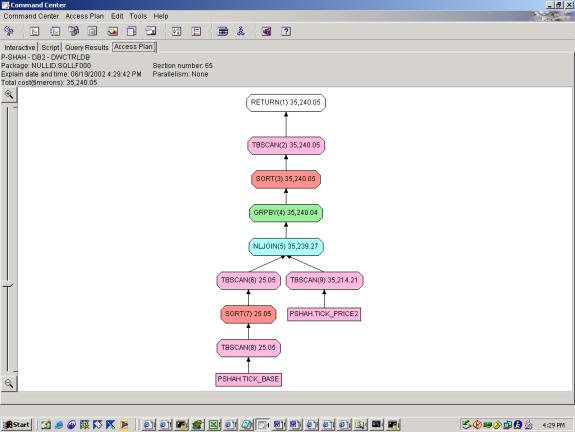

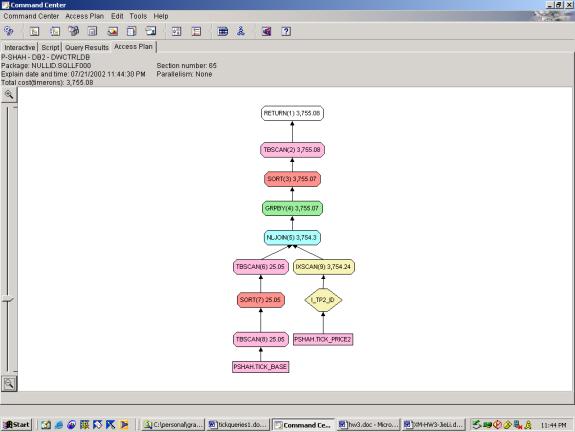

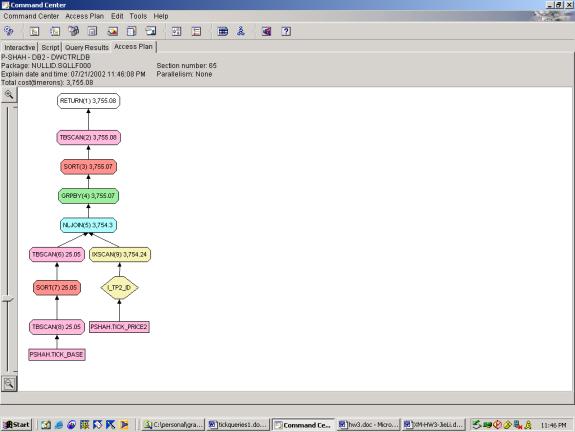

Syntax and Access Plans:

Query 5 involves a join of two relations, 1 predicate, 1 aggregation,

and an order on the aggregation result.

Q5.1 is an efficient access plan under the circumstances, as it involves

full tablescans on both TICK_PRICE2 and TICK_BASE2. The optimizer acknowledges that the second relation is much

smaller than the first, and thus rightly chooses the nested loop join. Once joined, the aggregation is performed

and its results are sorted.

Interestingly, the filter on TICK_BASE.SIC is done within the TICK_BASE2

tablescan operation (not apparent from the picture, but apparent when we look

at the detailed statistics). Thus, the

subsequent aggregation only occurs on the ids that have SIC=COMPUTERS which is

correct. Query 5.2 achieves

significant cost savings (10 times less) by replacing the full table scan on

TICK_PRICE2 with an index scan on TICK_PRICE2.

Otherwise the query is very similar to its predecessor. Query 5.3 adds an explicit rank to the

output using the OVER clause – the access plan and cost estimate are

identical. Q5.4 adds a top ten filter

(worth noting even though its not in the spec), which results in the addition

of one filter at the end of the plan – no cost added.

--Q5.1 MOST ACTIVE STOCKS (NO INDEXES)

SELECT count(1),a.id

FROM tick_price2 a,

tick_bASe b

WHERE a.id=b.id

AND b.SIC='COMPUTERS'

GROUP BY a.id

ORDER BY count(1) DESC

--Q5.2 MOST ACTIVE STOCKS (INDEXES)

SELECT count(1),a.id

FROM tick_price2 a,

tick_bASe b

WHERE

a.id=b.id

AND b.SIC='COMPUTERS'

GROUP BY a.id

ORDER BY count(1) DESC

--Q5.3 MOST ACTIVE STOCKS (INDEXES, USES OVER)

SELECT a.id, rank() OVER (ORDER BY count(1) DESC)

FROM tick_price2 a,

tick_bASe b

WHERE

a.id=b.id

AND b.SIC='COMPUTERS'

GROUP BY a.id

--Q5.4 MOST ACTIVE STOCKS (INDEXES, USES OVER, TOP TEN

FILTER INCLUDED)

WITH

allids (id, rank) AS (SELECT a.id,

rank() OVER (ORDER BY count(1) DESC)

FROM tick_price2 a,

tick_bASe b

WHERE

a.id=b.id

AND b.SIC='COMPUTERS'

GROUP BY a.id)

SELECT id

FROM allids

WHERE rank < 11

Detailed Analysis:

Query 5 demonstrates the ability of the Optimizer to use indexes, join

two relations, and perform the rank function.

As seen in attempts 5.3 and 5.4, the addition of the over clause and

subsequent filtering on the over clause add very little overhead. The fact that 5.2 and 5.3 have identical

access plans indicates that the over clause is handled exactly as an ORDER BY –

rightly so. This query also

demonstrates the ability of the optimizer to join 2 different relations – it

handles this well as one relation is significantly smaller than the other and

it uses a nested loop join. Also, the

filter on SIC is pushed down to the below the join which results in significant

cost savings.

Query 6

Specification:

|

6. |

Find the 10 stocks

with the highest percentage spreads. Spread is the difference between the

last ask-price and the last bid-price. Percentage spread is calculated as a

percentage of the mid-point price (average of ask and bid price). |

Syntax and Access Plans: Query 6 involves a calculation on 2 separate aggregations (max tradedate/timestamp where ask_price is not null and max tradedate/timestamp where bid_price is not null), with subsequent order on this calculation. 6.1 shows the best case query which achieves the correct results according to the specification. It still requires 2 full table scans on TICK_PRICE2 since the 2 aggregations are on different subsets of data – while the over clause allows for inline aggregations on different partitions of the same base data, it does not allow inline aggregations on different sets of base data. Thus, we cannot think of a way to reduce this query further. The optimizer rightly chooses the merge join since the two sets to be joined are of similar size. The final sort and filter are required since they act on the results of the joined data.

--Q6.1 HIGHEST PERC SPREAD (INDEXES, USES OVER, 2 TABLE

SCANS ON TICK_PRICE2, TOP TEN FILTER INCLUDED, NO DATE FILTERS)

WITH

LAStB (id, bidprice, lASttime) AS

(SELECT id, bidprice, ROW_NUMBER()

OVER (PARTITION BY id ORDER BY

tradedate,timestamp DESC) AS rown

FROM Tick_price2

WHERE bidprice is not null),

LAStA (id,ASkprice, lASttime) AS

(SELECT id, ASkprice, ROW_NUMBER()

OVER (PARTITION BY id ORDER BY

tradedate,timestamp DESC) rown

FROM Tick_price2

WHERE ASkprice is not null),

allids (id, rank) AS

(SELECT a.id, rank() OVER (ORDER BY (2*(b.ASkprice-a.bidprice) /

(b.ASkprice+a.bidprice)) DESC)

FROM

LAStB a, LAStA b

WHERE

a.id=b.id

AND a.lASttime=1

AND b.lASttime=1)

SELECT id

FROM allids

WHERE rank < 11

Detailed Analysis:

While we do not show the progression, this query is similar to Query 3.

Without the over clause we would potentially require 4 full table scans instead

of 2. However, as stated in the

previous section, we realize a limitation of the over clause in this query – we

cannot perform inline aggregations on different sets of base data (see above

for further explanation). The

optimizer does well with the Over clause – treats it just as if it were an

ORDER BY, and correctly merge joins the two similar-sized data sets. The final sort and filter are appropriate as

they rely on the results of the join.

Markets

Query 1

Specification:

|

1 |

Get the closing

price of a set of 10 stocks for a 10-year period and group into weekly,

monthly and yearly aggregates. For each aggregate period determine the low,

high and average closing price value. The output should be sorted by id and

trade date. |

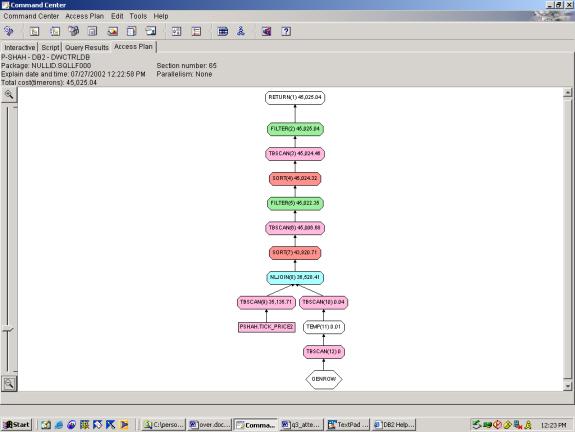

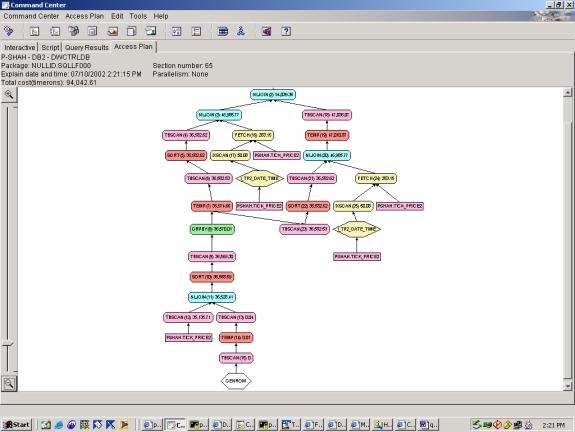

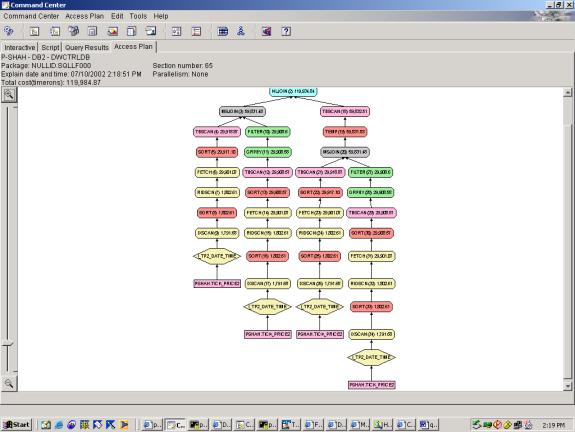

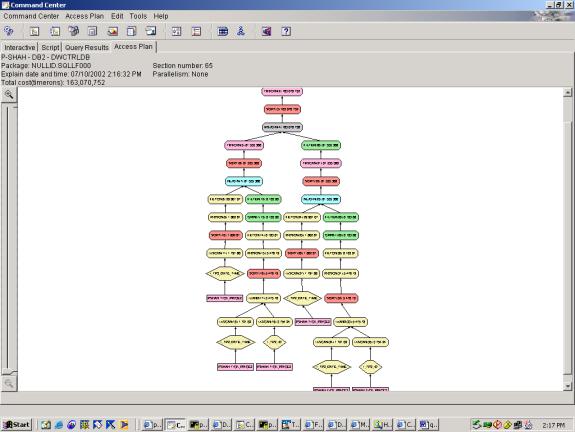

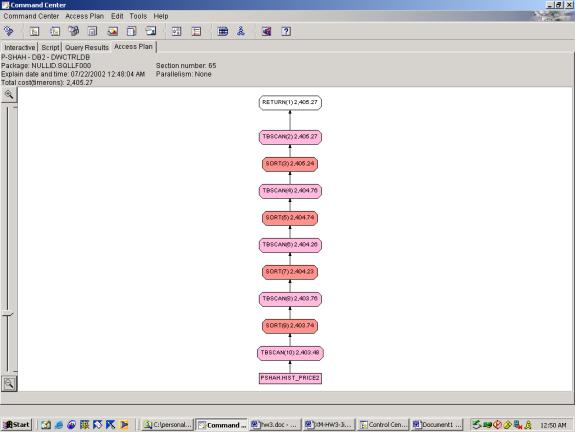

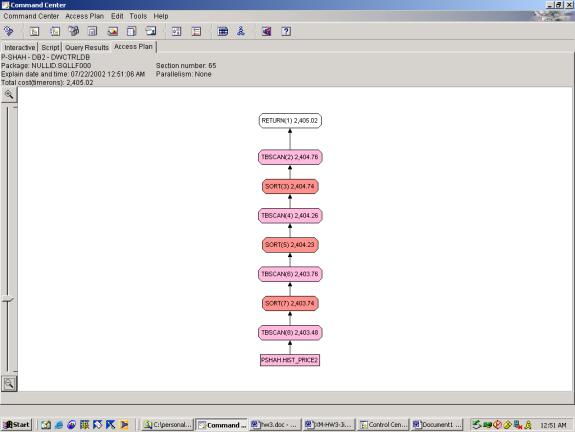

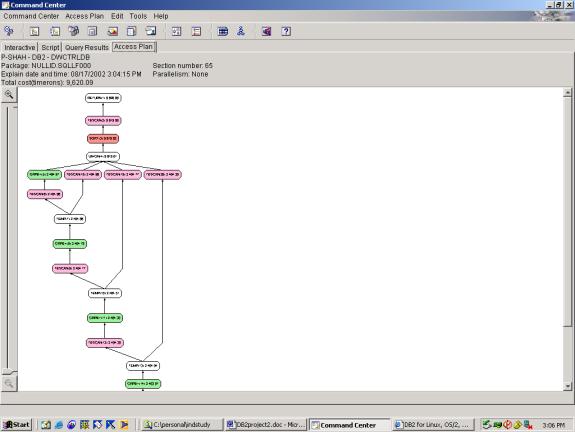

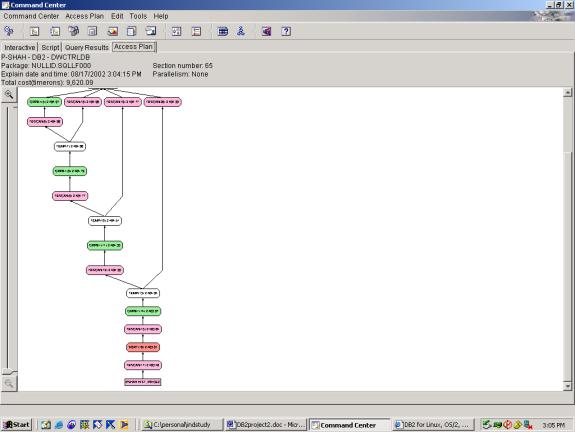

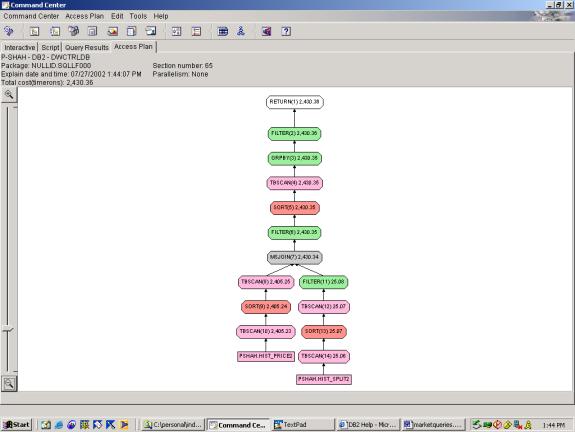

Syntax and Access Plan: Markets Query 1 involves 3 aggregations, over 3 different partitions, over the same base set of data. The first 2 attempts use the OVER clause and the last attempt uses the ROLLUP clause. Both achieve the results as stated in the specification. Q1.1 shows that the optimizer allows the sorts to be re-used in different aggregations of the same partition – which is correct. It also shows that sorts are able to build off of each other – that is, it performs the weekly, monthly and yearly sort with each one feeding into the next – which is also correct. Interestingly, in Q1.3, the rollup, although better suited for this query, results in a less efficient access plan. It seems to do each aggregation separately and then union the results rather than a sequential plan as in 1.2 and 1.1. Perhaps since the aggregates in this query are hierarchical – that is, they are all based on the same column, tradedate – the OVER clause performs better than ROLLUP.

--Q1.1 CLOSE PRICE OVER WEEK, MONTH, YEAR AGGREGATES (WITH

ORDER)

SELECT

id,

tradedate,

max(closeprice) OVER (PARTITION BY

id, month(tradedate)),

min(closeprice) OVER (PARTITION BY

id, month(tradedate)),

avg(closeprice) OVER (PARTITION BY

id, month(tradedate)),

max(closeprice) OVER (PARTITION BY

id, year(tradedate)),

min(closeprice) OVER (PARTITION BY

id, year(tradedate)),

avg(closeprice) OVER (PARTITION BY

id, year(tradedate)),

max(closeprice) OVER (PARTITION BY

id, week(tradedate)),

min(closeprice) OVER (PARTITION BY

id, week(tradedate)),

avg(closeprice) OVER (PARTITION BY

id, week(tradedate))

FROM

hist_price2

WHERE year(tradedate) = 2002

AND id LIKE '%_11%'

ORDER BY id, tradedate

--Q1.2 CLOSE PRICE OVER WEEK, MONTH, YEAR AGGREGATES

(WITHOUT ORDER)

SELECT

id,

tradedate,

max(closeprice) OVER (PARTITION BY

id, month(tradedate)),

min(closeprice) OVER (PARTITION BY

id, month(tradedate)),

avg(closeprice) OVER (PARTITION BY

id, month(tradedate)),

max(closeprice) OVER (PARTITION BY

id, year(tradedate)),

min(closeprice) OVER (PARTITION BY

id, year(tradedate)),

avg(closeprice) OVER (PARTITION BY

id, year(tradedate)),

max(closeprice) OVER (PARTITION BY

id, week(tradedate)),

min(closeprice) OVER (PARTITION BY

id, week(tradedate)),

avg(closeprice) OVER (PARTITION BY

id, week(tradedate))

FROM

hist_price2

WHERE year(tradedate) = 2002

AND id LIKE '%_11%'

--Q1.3 CLOSE PRICE OVER WEEK, MONTH, YEAR AGGREGATES (ROLLUP

WITH ORDER)

SELECT

id,

year(tradedate),

month(tradedate),

week(tradedate),

max(closeprice),

min(closeprice),

avg(closeprice)

FROM

hist_price2

WHERE year(tradedate) = 2002

AND id LIKE '%_11%'

group by rollup ((id,year(tradedate)),

(id,month(tradedate)),

(id,week(tradedate)))

order by id, year(tradedate),

month(tradedate),

week(tradedate)

(top view)

(bottomview)

Detailed Analysis:

The optimizer handles aggregations using the OVER clause very well in

the case of 1.1. and 1.2. Since all

aggregations build off the same column (tradedate), the optimizer is able to

reuse the results of each sort. In the

case of the ROLLUP in 1.3, the optimizer must perform the extra step of

union-ing the results of each aggregation.

This adds significant overhead.

Query 2

Specification:

|

2 |

Adjust all prices

and volumes (prices are multiplied by the split factor and volumes are

divided by the split factor) for a set of 1000 stocks to reflect the split

events during a specified 300 day period, assuming that events occur before

the first trade of the split date. These are called split-adjusted prices and

volumes. |

Syntax and Access Plan:

Query 2 is complex at first, but greatly simplified with a little bit of

high school math. Realizing that the

PRODUCT() aggregate function can be substituted with:

Product xi = exp

(S ln (xi))

We have an efficient plan that achieves the results

required. As a sidenote, we initially

approached this query by thinking about 1) the WITH RECURSIVE clause, and 2)

User Defined Functions. However, we

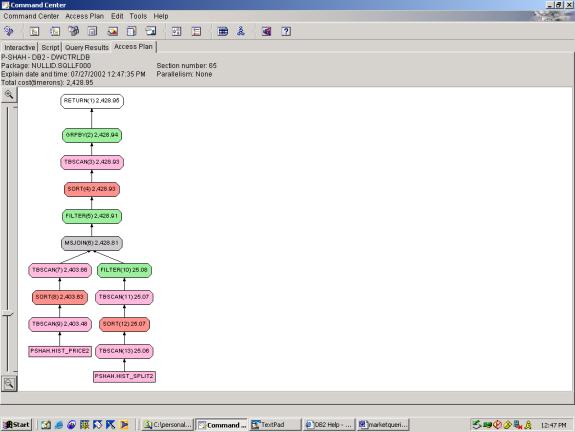

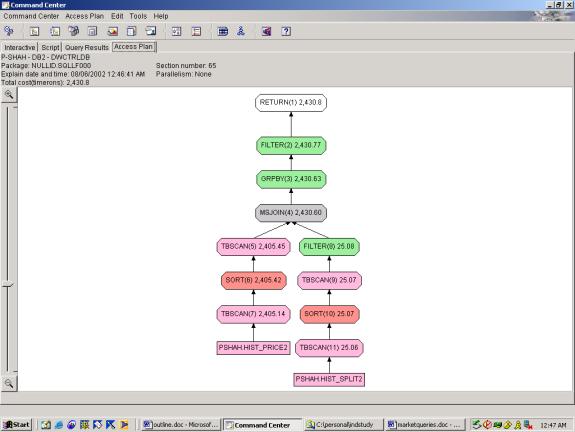

realized these costly options were not necessary as stated above. Query 2.1 involves 2 aggregations, 1

cartesian-outer join between different relations and 2 predicates. The plan scans both tables, and joins the

results using a merge join.

--Q2.1 SPLIT ADJUSTED PRICE AND VOLUME

SELECT a.id,

tradedate,

value(exp(sum(ln(value(b.splitfactor,1)))),1)

adj_split_factor,

closeprice*value(exp(sum(ln(value(b.splitfactor,1)))),1)

adj_price,

volume / value(exp(sum(ln(value(b.splitfactor,1)))),1)

adj_volume,

closeprice,

volume

FROM

hist_price2 a left outer join hist_split2 b

on a.id=b.id

AND a.tradedate<b.splitdate

WHERE a.id LIKE '%_1%'

AND year(tradedate)=2002

GROUP BY a.id, tradedate, closeprice, volume

Detailed Analysis:

The plan is adequate given the 2 relations and the Cartesian outer

join. The optimizer chooses the merge

join – possibly due to the Cartesian outer join - it does not have any concrete information on the size of the 2

data sets to be joined. Thus, is does

not use a nested loop join here, which seems correct. It performs the aggregation <sort, tablescan, groupby> on

the results of the join correctly. It

handles order pretty well as can be seen by the 2 sorts in the subtrees – these

sorts make the subsequent merge join more efficient.

Query 3

Specification:

|

3 |

For each stock in

a specified list of 1000 stocks, find the differences between the daily high

and daily low on the day of each split event during a specified period. |

Syntax and Access Plans:

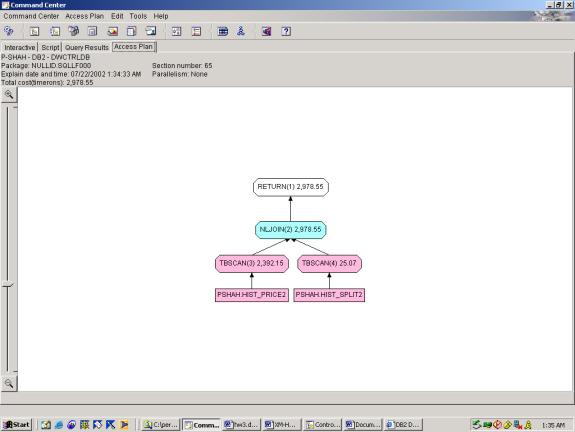

Query 3 is simple – it involves selection from 2 joined relations with a

single predicate. There is no

aggregation or order. The optimizer

does a full tablescan on both tables and then joins using a nested loop

join. This makes sense because one

relation is much smaller than the other.

--Q3.1 DAILY HI/LOW ON SPLITDATE

SELECT a.id, tradedate,

lowprice, highprice

FROM

hist_price2 a,

hist_split2 b

WHERE a.id=b.id

AND a.tradedate=b.splitdate

Detailed Analysis: The optimizer chooses the proper join

method, and performs 2 full tablescans which is adequate given the

requirements.

Query 4

Specification:

|

4 |

Calculate the

value of the S&P500 and Russell 2000 index for a specified day using

unadjusted prices and the index composition of the 2 indexes (see appendix

for spec) on the specified day |

Syntax and Access Plans:

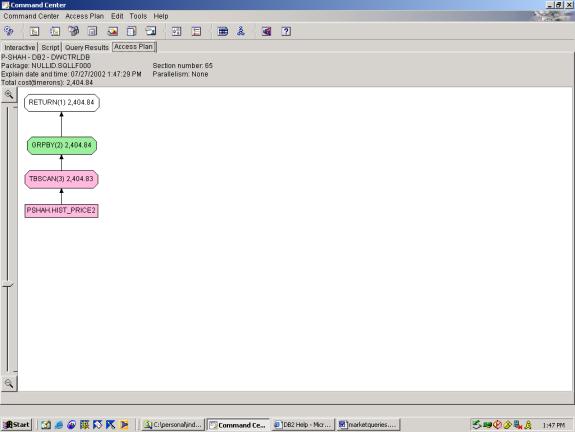

Both parts of Query 4 requires 1 aggregation and 2 predicates. They have simple access plans which show a

tablescan followed by a group by.

--Q4.1 RUSSELL AND SP INDICES -- AS TWO SEPARATE QUERIES

SELECT avg(closeprice) Russell200

FROM

hist_price2

WHERE tradedate='6/25/2002'

AND id LIKE 'Security_1%'

SELECT avg(closeprice) SP5

FROM

hist_price2

WHERE tradedate='6/25/2002'

AND id LIKE 'Security_10%'

Detailed Analysis:

Query 4 is handled adequately by the optimizer – we cannot think of any

better alternatives for the simple plan.

Query 5

Specification:

|

5 |

Find the 21-day

and 5-day moving average price for a specified list of 1000 stocks during a

6-month period. (Use split adjusted prices) |

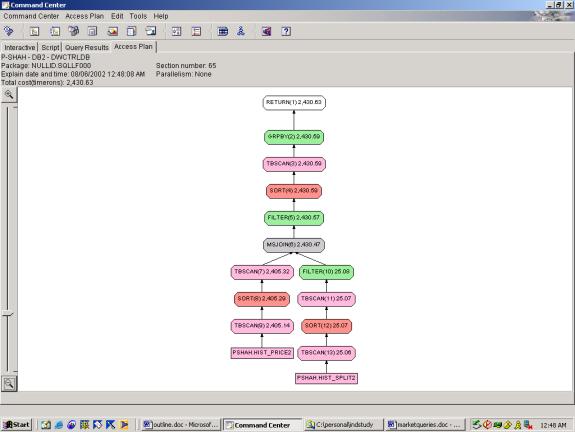

Syntax and Access Plans: Building off of Query 2, this query

adds 2 aggregations with different windowing groups, and 2 predicates. The moving averages rely on the fact that

the data in the Markets database is regular time series, hence the use of the

ROWS clause. Query 5.1 shows the basic

plan, while 5.2 and 5.3 attempt to show how well the optimizer pushes down the

filters. In all three cases, the ID

filter and YEAR filter occur as part of the first tablescan on

HIST_PRICE2. The subsequent operations,

until the join, are the same as Query 2.

In all three cases, there is a filter and a group by operation after the

join.

--Q5.1 21 DAY AND 5 DAY MOVING AVG.

WITH

splitadj (id, tradedate, adjprice,

adjvolume) as (SELECT a.id,

tradedate,

closeprice*value(exp(sum(ln(value(b.splitfactor,1)))),1) adj_price,

volume /

value(exp(sum(ln(value(b.splitfactor,1)))),1) adj_volume

FROM

hist_price2 a left outer join

hist_split2 b

on a.id=b.id

AND a.tradedate<b.splitdate

WHERE a.id LIKE '%_1%'

AND year(tradedate)=2002

GROUP BY a.id, tradedate,

closeprice, volume)

SELECT

id,

tradedate,

avg(adjprice) OVER (PARTITION BY id ORDER BY tradedate asc

ROWS between 21 preceding AND current row) day21,

avg(adjprice) OVER (PARTITION BY id ORDER BY tradedate asc

ROWS between 5 preceding AND current row) day5

FROM

splitadj

WHERE

id LIKE 'Security_1%'

AND year(tradedate)=2002

--Q5.2 21 DAY AND 5 DAY MOVING AVG.

(compare to Q5.3 – shows push down ability)

WITH

splitadj (id, tradedate, adjprice, adjvolume) as (SELECT

a.id,

tradedate,

closeprice*value(exp(sum(ln(value(b.splitfactor,1)))),1) adj_price,

volume / value(exp(sum(ln(value(b.splitfactor,1)))),1)

adj_volume

FROM

hist_price2 a left outer join hist_split2 b

on a.id=b.id

AND a.tradedate<b.splitdate

GROUP BY a.id, tradedate, closeprice, volume)

SELECT

id,

tradedate,

avg(adjprice) OVER (PARTITION BY id ORDER BY tradedate asc

ROWS between 21 preceding AND current row) day21,

avg(adjprice) OVER (PARTITION BY id ORDER BY tradedate asc

ROWS between 5 preceding AND current row) day5

FROM

splitadj

WHERE

id LIKE 'Security_1%'

AND year(tradedate)=2002

--Q5.3 21 DAY AND 5 DAY MOVING AVG. (compare to Q5.2 – shows push down ability)

WITH

splitadj (id, tradedate, adjprice, adjvolume) as (SELECT

a.id,

tradedate,

closeprice*value(exp(sum(ln(value(b.splitfactor,1)))),1) adj_price,

volume / value(exp(sum(ln(value(b.splitfactor,1)))),1)

adj_volume

FROM

hist_price2 a left outer join hist_split2 b

on a.id=b.id

AND a.tradedate<b.splitdate

WHERE

a.id LIKE 'Security_1%'

AND year(a.tradedate)=2002

GROUP BY a.id, tradedate, closeprice, volume)

SELECT

id,

tradedate,

avg(adjprice) OVER (PARTITION BY id ORDER BY tradedate asc

ROWS between 21 preceding AND current row) day21,

avg(adjprice) OVER (PARTITION BY id ORDER BY tradedate asc

ROWS between 5 preceding AND current row) day5

FROM

Splitadj

Detailed Analysis:

Query 5.1 makes it easy on the optimizer by putting the filters in both

the subquery and outer query. Query 5.2

keeps the filters in the outer query only, and 5.3 keeps the filters in the

subquery only. In all cases the

relative cost is the same. Thus, it

seems to be successfully pushing down filters in this case. Looking at more detail, we see that Query

5.3 applies the YEAR filter three times.

In Query 5.2, it is applied twice.

In Query 5.1, it is applied once.

So, even though the cost estimates show that all three have the same

cost, we can see that there are the least steps taken in Query 5.1. The first half of the access plan (through

the MSJOIN) is identical to Query 2 – see comments above on the optimizer

analysis. The grouping operation takes

care of both aggregations (5 day and 21 day) – which is correct.

Query 6

Specification:

|

6 |

(Based on the

previous query) Find the points (specific days) when the 5-month moving

average intersects the 21-day moving average for these stocks. The output is

to be sorted by id and date. |

Syntax and Access Plan:

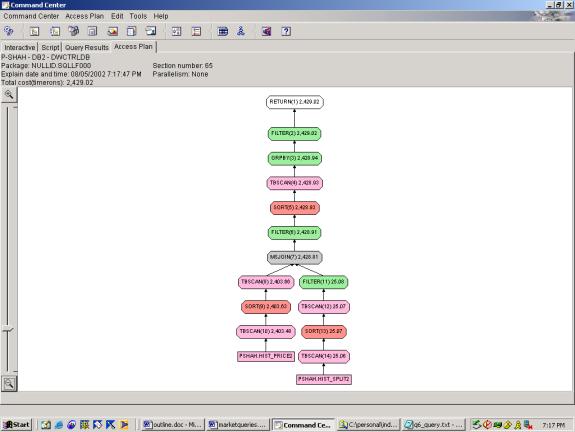

Query 6 builds from Query 5. It

simply adds 1 aggregation and a new predicate.

Interestingly, the added calculations result in a lower cost plan, and

there is no extra work for the aggregation, and the new predicate is calculated

at the end after the aggregation – which is correct since the predicate is

dependent on the aggregation.

--Q6.1 21 DAY AND 5 DAY POINTS OF INTERSECTION

WITH

splitadj (id, tradedate, adjprice,

adjvolume) as (SELECT a.id,

tradedate,

closeprice*value(exp(sum(ln(value(b.splitfactor,1)))),1) adj_price,

volume /

value(exp(sum(ln(value(b.splitfactor,1)))),1) adj_volume

FROM

hist_price2 a left outer join

hist_split2 b

on a.id=b.id

and a.tradedate<b.splitdate

WHERE a.id like '%Security_1%'

and year(tradedate)=2002

GROUP BY a.id, tradedate,

closeprice, volume),

mov21_5 (id, tradedate, day21,

day5)

as (SELECT id, tradedate,

avg(adjprice) over (PARTITION BY id order by tradedate asc ROWS between 21

preceding and current row) day21,

avg(adjprice) over (PARTITION BY

id order by tradedate asc ROWS between 5 preceding and current row) day5

FROM

splitadj),

mov21_5cross (id, tradedate,

day21prev, day5prev)

as

(SELECT id, tradedate, avg(day21)

over (PARTITION BY id order by tradedate rows between 2 preceding and 1

preceding),

avg(day5) over (PARTITION BY id

order by tradedate rows between 2 preceding and 1 preceding),

day21,

day5

FROM mov21_5)

SELECT *

FROM mov21_5cross

WHERE sign(day21-day5)*sign(day21prev-day5prev) < 0

Detailed Analysis: Query 6 builds from Query 5 and Query 2. The plan is identical to Query 5 except that it includes an extra filter at the end to accommodate the new predicate. This filter must come at the end because it is dependent on the results of the aggregation. The optimizer pushes down filters well in this case.

Query 8

Specification:

|

8 |

Find the pair-wise

coefficients of correlation in a set of 10 securities for a 2 year period.

Sort the securities by the coefficient of correlation, indicating the pair of

securities corresponding to that row. [Note: coefficient of correlation

defined in appendix] |

Syntax and Access Plans:

Query 8 involves a Cartesian join between 2 relations, with 1 aggregate

function and an ordering on the aggregation.

The optimizer chooses a nested loop join followed by the group by

pattern <sort, tablescan, groupby>, followed by a sort. The aggregation must occur after the join

and the sort must occur after the aggregation since each depends on the last

operation.

--Q8.1 PAIR WISE COEFFICIENTS

SELECT

a.id,

b.id,

correlation(a.closeprice, b.closeprice)

FROM

(SELECT * FROM hist_price2 WHERE id LIKE 'Security_10%' AND

(tradedate='6/25/2002' or tradedate='6/26/2002' or tradedate='6/27/2002')) a,

(SELECT * FROM hist_price2 WHERE id LIKE 'Security_20%' AND

(tradedate='6/25/2002' or tradedate='6/26/2002' or tradedate='6/27/2002')) b

WHERE

a.tradedate=b.tradedate

group by a.id, b.id

order by correlation(a.closeprice, b.closeprice)

Detailed Analysis:

Query 8 involves a Cartesian join between 2 relations of equal

size. The 2 relations are subqueries

with 1 predicate each. The filters are

performed as part of the tablescan, correctly.

The optimizer chooses a nested loop join – however the 2 relations are

of equal size. We believe that a merge

join would have been better here. Next,

it performs the aggregation, and sorts the results of the aggregation – which

is satisfactory.

Query 9

Specification:

|

9 |

Determine the

yearly dividends and annual yield (dividends/average closing price) for the

past 3 years for all the stocks in the Russell 2000 index that did not split

during that period. Use unadjusted prices since there were no splits to

adjust for. |

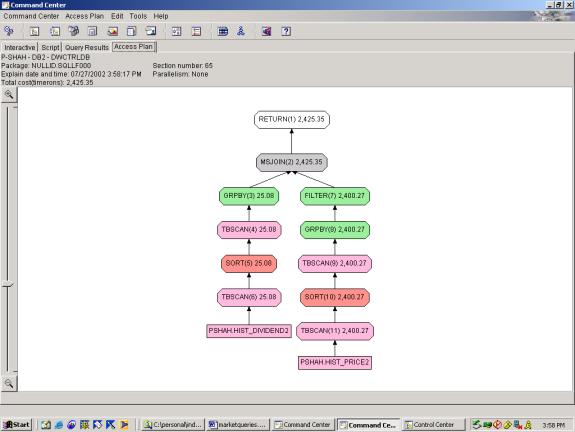

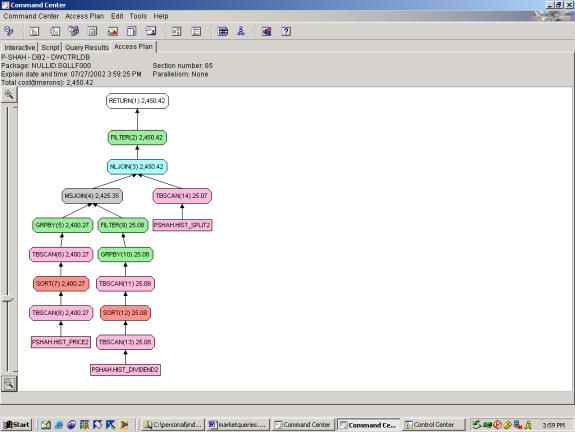

Syntax and Access Plan: Query 9 is a selection from 2 joined relations with 3 predicates. The 2 relations are subqueries which each have 1 predicate and 1 aggregation. The access plan for 9.1 shows a full tablescan on each relation, followed by the aggregation, followed by a merge join. In 9.2, we add the criteria that the security did not have any splits – this introduces a third relation. In 9.2, the access plan shows a full tablescan on each relation, followed by the aggregation, followed by a merge join – next, there is an outer join with the 3rd relation – for which the optimizer chooses the nested loop join.

--Q9.1 YEARLY DIVIDENDS AND ANNUAL YIELD (SELECTS ALL – NOT

JUST SECURITIES THAT HAVE NOT HAD SPLITS).

CHANGED THIS TO MONTHLY DIV AND MONTHLY YIELD B/C OF SMALLER SET OF DATA

SELECT

a.id,

a.totaldiv as month_divs,

a.totaldiv / b.avgprice

as month_yield

FROM

(SELECT id, sum(divamt) totaldiv FROM hist_dividend2 WHERE

month(divdate)=7 GROUP BY id) a,

(SELECT id, avg(closeprice) avgprice FROM hist_price2 WHERE

month(tradedate) = 7 GROUP BY id) b

WHERE a.id=b.id

AND (a.id = 'Security_2' or a.id = 'Security_3') -- as Russell index criteria

(should be SELECTing not split adjusted) / additional criteria in spec

--Q9.2 YEARLY DIVIDENDS AND ANNUAL YIELD (SELECTS ONLY

SECURITIES THAT HAVE NOT HAD SPLITS)

CHANGED THIS TO MONTHLY DIV AND MONTHLY YIELD B/C OF SMALLER SET OF DATA

SELECT

a.id,

a.totaldiv as month_divs,

a.totaldiv / b.avgprice

as month_yield

FROM

(SELECT id, sum(divamt) totaldiv FROM hist_dividend2 WHERE

month(divdate)=7 GROUP BY id) a,

(SELECT id, avg(closeprice) avgprice FROM hist_price2 WHERE

month(tradedate) = 7 GROUP BY id) b

WHERE a.id=b.id

AND (a.id = 'Security_2' or a.id = 'Security_3')

AND not exists (SELECT 'x' FROM hist_split2 c

WHERE c.id=a.id)

Detailed Analysis:

In Query 9.1, the optimizer performs adequately. It chooses the merge join for 2 equal size

relations. However, in query 9.2 it

applies the outer join with HIST_SPLIT2 after the merge join. We feel that this would be more efficient if

applied before the merge join – it would lessen the amount of rows to be merge

joined.

Test Results Summary

The tables below show a summary of

the best-case plans for each query. For

detailed query rewrite attempts and access plans, please see Test Results

Detail.

Query Syntax

The following tables show, for each data model, the relative

readability and development effort involved for each of the best-case

queries.

Readability categories are:

Simple – uses basic SQL constructs for the purposes intended and

no mathematical formulas or “work-arounds” to achive the reuslts, Average

– uses basic SQL constructs including

SQL 99 additions for purposes intended and no mathematical formulas, Complex

– uses mathematical formulas or “work arounds” to achieve desired results.

Development categories are:

Easy – a person with knowledge of SQL92 can write the query with

less than 3 attempts, Average – a person with detailed knowledge of

SQL92 and basic knowledge of SQL99 can write the query with less than 3

attempts, Difficult – a person with detailed knowledge of SQL92, SQL99

and mathematical formulas can write the query in less than 10 attempts.

Ticks Database

Query |

Query Type |

Query Readability |

Query Development |

|

Q1.2 |

Simple Selection from Single Table with 3 Predicates |

Simple |

Easy |

|

Q2.2 |

Selection from Single Table with 3 Predicates and 1

Aggregation |

Simple |

Easy |

|

Q3.1 |

Top Ten Filter, 3 Aggregate Functions on different

partitions, Selection on a Single Table, 3 Subqueries – each building on the

last. Uses an OVER clause. |

Complex |

Difficult |

|

Q4.4 |

1 Aggregation, Top Ten Filter, 1 Predicate. Uses an OVER clause. |

Simple |

Average |

|

Q5.4 |

Ordering on Aggregate,

Table Join on Primary Key, 1 Predicate, 1 Aggregation. Uses an OVER clause. |

Average |

Difficult |

|

Q6.4 |

Top Ten Filter, 2

Aggregate functions on 2 different subsets of data. Selection on a single Table.

3 SubQueries building on each other.

Uses an OVER clause. |

Complex |

Difficult |

Markets Database

|

Query |

Query Type |

Query Readability |

Query Development |

|

Q1.1 |

3 Aggregate Functions on Different Time Periods, Selection

on Single Table, 2 Predicates, SORT on result set. Uses an OVER clause. |

Simple |

Average |

|

Q2.1 |

Selection on 2 Tables - Outer Joined, 2 Aggregate Functions, 2 Predicates. |

Complex |

Difficult |

|

Q3.1 |

Selection on 2 Tables – Joined. |

Simple |

Simple |

|

Q4.1 |

Selection on Single Table, 1 Aggregate Function, 2

Predicates |

Simple |

Simple |

|

Q5.3 |

2 Aggregate Functions on different partitions, Single

Subquery which includes 1 Aggregate Function and an Outer Join of 2 Tables, 2

Predicates. Uses an OVER clause. |

Complex |

Difficult |

|

Q6.1 |

Building on Query 5, this one adds 2 additional Aggregate

Functions on different partitions. It

also adds a Predicate. Uses an OVER

clause. |

Complex |

Difficult |

|

Q8.1 |

1 Cartesian join, 1 aggregate function, 1 sort. |

Complex |

Average |

|

Q9.2 |

Selection on 2 Subqueries, each involving different

aggregate functions and inner joined.

1 Predicate and 1 NOT EXISTS. |

Complex |

Difficult |

Query Optimization

The tables below show the Optimizer performance for each of

the best-case queries for the Ticks and Markets databases. Cost Optimization ratings are Poor –

we can find a better plan, Average – we cannot find a better plan but

the optimizer does what we expect it to do, Excellent – we cannot find a

better plan and the optimizer uses a particularly creative approach that we

would not have expected. Total Cost is

in units of timerons, and ratings are: Low

<5k, Medium between 5k and 15k, High >15k.

Ticks Database

|

Query |

Query

nnnnnnssc Type |

Total Cost |

Join Method and Join Order |

Sort Order |

Selection Method |

Application of Filters |

|

Q1.2 |

Simple Selection from Single Table with 3 Predicates. Not ORDER Dependent. |

12711 Medium |

None |

No explicit sort, however the optimizer SORTS the result

of the INDEX SCAN on ROWID prior to looking up rows. This is very smart because it saves

multiple lookups to the same page (which would be the case if it was not

sorted on ROWID). Excellent. |

Uses 2 Index Scans, and ANDs the result. Average. |

None |

|

Q2.2 |

Selection from Single Table with 3 Predicates and 1

Aggregation. Not ORDER Dependent. |

12697 Medium |

None |

Same as Q1.2. Excellent. |

Same as Q1.2. Average. |

None |

|

Q3.1 |

Top Ten Filter, 3 Aggregate Functions on different

partitions, Selection on a Single Table, 3 Subqueries – each building on the

last. Order Dependent. Uses OVER. |

45025 High |

Nested Loop Join with Literal Table Average |

2 Sorts –

One on ID and Tradedate (single sort for 2 grouping functions). The second sort is on PercentageLoss

(couldn’t’ be pushed down because its dependent on an aggregate). Because we eliminated all except on full

tablescan (and hence all joins), we also eliminated extraneous SORTS – a huge

cost savings. The rationale of the

attempts was essentially to reduce joins.

A clustering index over ID and tradedate potentially eliminates the

first sort. Excellent |

Uses a Table Scan.

Could have used an Index Scan.

Its not clear why it fails to use the INDEX. Possibly due to the introduction of the Literal Table. Poor |

2 Filters – One on Rank (couldn’t be pushed down because

its dependent on an aggregate). The

second filter is on Tradedate – this could have been pushed down but wasn’t. Since the

TRADEDATE filter reduces the number of records significantly, this query is

greatly adversely affected by the fact that the filter is not pushed

down. Poor |

|

Q4.4 |

Selection from Single Table, 1 Aggregation Top Ten Filter, 1 Predicate. Order Dependent. Uses OVER. |

29916 High |

None |

There are

3 SORTS, (i) The first is similar to Q1.2.

Excellent, (ii) the second is part of the aggregation pattern where

we group on ID to get the rank – however, why sort again on ID when it was

already sorted on ID in the first sort Poor, (iii) the third sort

sorts on the result of the rank which must occur at the end, as expected Average |

Uses Index. Average. |

Filter is applied at the end. It is not possible to push down because it depends on the

result of the aggregate. As

expected. Average. |

|

Q5.4 |

Ordering on Aggregate,

Table Join on Primary Key, 1 Predicate, 1 Aggregation. Order Dependent. Uses OVER. |

3755 Low |

Nested Loop Join between ID Index on Tick_Price2 and

Tick_Base. Average |

Clever SORT is implemented after the Tick_Base TableScan –

this aids the Nested Loop Join between Tick_Base and Tick_Price2. Excellent |

Uses Index on Tick_Price2, and TableScan on

Tick_Base. Average |

Filter is applied at the end (could not push down because

it depends on the result of the rank).

Average |

|

Q6.4 |

Top Ten Filter, 2

Aggregate functions on 2 different subsets of data. Selection on a single Table.

3 SubQueries each building on each other. Order Dependent.

Uses OVER. |

59875 High |

Merge Join Between Each Copy of the Index Scan on

Tick_Price2. This is an efficient

Join method for 2 sorted sets of data relatively equal in size. Even though

the sources are not originally sorted, the nested loop join is close to O(n2),

while the merge join is O(nlogn) Excellent. |

Clever Sorts Are Inlcuded in two places: (i) After IndexScan Before ROWID Lookup,

(ii) After TableScan, and Before MS JOIN.

It is clever for the same reason as Q1.2 - Each of these makes the

next step more efficient by reducing the number of disk reads when performing

the ROWID lookup in (i), and when performing the join. Excellent |

2 Index Scans on Tick_Price2. Average |

4 Filters: (i) Filter on Rank – must be done at the end

due to dependence on aggregate result Average, (ii) Filter on Ask Price – why not do this

prior to the Second SORT thereby reducing the number of elements to join Poor (iii) Filter on Bid Price – why

not do this prior to Second SORT – thereby reducing the number of elements to

join Poor, (iv) Filter on Join. Average |

Markets Database

|

Query |

Query Type |

Total Cost |

Join Method and Join Order |

Sort Order |

Selection Method |

Application of Filters |

|

Q1.1 |

3

Aggregate Functions on Different Time Periods, Selection on Single Table, 2

Predicates, SORT on result set. Order

Dependent. Uses OVER. |

2405 Low |

None |

3 Separate Sorts for the 3 Aggregate Functions. We can’t think of any way around

this. Final Sort for ID,

Tradedate. This could have been

pushed down, but wasn’t. Average |

Table Scan on Hist Price2. Average |

None |

|

Q2.1 |

Selection on 2 Tables - Outer Joined, 2 Aggregate Functions, 2 Predicates Order

Dependent. |

2430 Low |

Merge Join Between SPLIT2 and HIST2. Average |

2 SORTS: (i) one sort prior to the Merge Join. Average (ii) one is part of the

Group BY Pattern as expected. Average

|

2 TableScans which is as expected. Average |

None |

|

Q3.1 |

Selection on 2 Tables – Natural Joined. NOT Order Dependent. |

2980 Low |

None |

None |

1 TableScan, as expected. Average |

None |

|

Q4.1 |

Selection on Single Table, 1 Aggregate Function, 2 Predicates. NOT Order Dependent.

|

2404 Low |

Nested Loop Join.

This is appropriate because SPLIT2 is much smaller than PRICE2. Average |

None |

2 TableScans (on PRICE2 and SPLIT2). As expected. Average |

None |

|

Q5.3 |

2 Aggregate Functions on different partitions, Single

Subquery which includes 1 Aggregate Function and an Outer Join of 2 Tables, 2

Predicates. Order Dependent. Uses OVER. |

2430 Low |

Merge Join Between SPLIT2 and HIST2. Average |

2 SORTS: (i) one sort prior to the Merge Join. Average (ii) one is part of the

Group BY Pattern as expected. Average

|

2 TableScans which is as expected. Average |

Filter (on Tradedate and ID) is Pushed Down – Q5.2 and

Q5.3 demonstrate this ability. Excellent |

|

Q6.1 |

Building on Query 5, this one adds 2 additional Aggregate

Functions on different partitions. It

also adds a Predicate. Order

Dependent. Uses OVER. |

2430 Low |

Merge Join Between SPLIT2 and HIST2. Average |

2 SORTS: (i) one sort prior to the Merge Join. Average (ii) one is part of the

Group BY Pattern as expected. Average

|

2 TableScans which is as expected. Average |

Filter selects cross points -at the end because it is

dependent on the result of the subqueries.

Average |

|

Q8.1 |

Partial Cartesian Join Between Two Copies of a Single

Table, One Aggregate Function. Order

Dependent. |

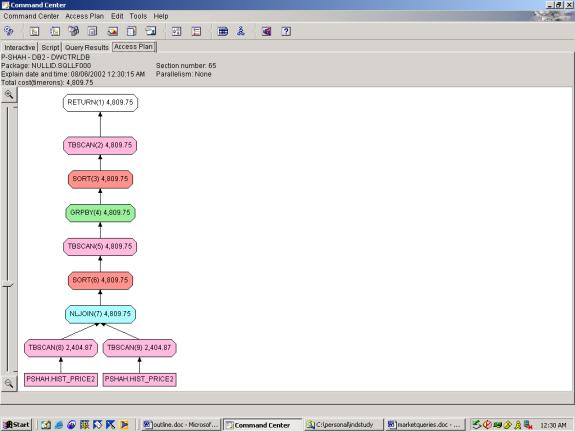

4809 Low |

Nested Loop Join Between Two Copies of the Same

Table. Why Nested Loops Here. We have no reason to believe one Copy is

smaller than the other. A better

approach is to SORT and then Merge Join.

Poor |

2 SORTS: (i) one is part of the Group BY Pattern as

expected. Average (ii) sorts

the correlation coefficient at the end, because it is dependent on the

aggregate result. Average |

2 TableScans which is as expected. Average |

None |

|

Q9.2 |

Selection on 2 Subqueries, each involving different

aggregate functions and inner joined.

1 Predicate and 1 NOT EXISTS. Order

Dependent. |

2450 Low |

Merge Join Between PRICE2 and DIVIDEND2. Nested Loop Join between the output of

the above and SPLIT2. Average. |

2 Sorts as part of the Group By. Average |

Table Scan on all 3 tables. Average |

2 Filters (i) one for the Join between PRICE2 and DIVIDEND

Average, (ii) one for the NOT EXISTS Clause. Could have been pushed down.

Poor |

Analysis & Conclusions

Query Optimization

Pushing Down

Selections

Markets Query Q5.2 and Q5.3 can be used to show how

effective the DB2 query optimizer is at pushing down selections. By moving around the Predicates (on ID and

TRADEDATE) from the subquery (in Q5.2) to the outer query (in Q5.3), we see

that the Filter remains in the first TableScan. Thus it is successfully pushed down to the first table

scan of the table.

Another example of successful push down is the fact

that Markets Queries 2.1, 5.1 and 6.1 all have almost the exact same access

plan, but they are increasingly complex version of the same query. Since 6.1 has significantly more